A New World of

Alternative Investments

Access Capital Management LLC, a subsidiary of Access Alternative Investments, Inc., as a fiduciary, focuses on originating and managing asset-based institutional-quality alternative investments across multiple sectors. We are a premier asset management firm that specializes in delivering superior risk-adjusted returns that are largely uncorrelated to public markets and economic cycles.

Mandate

Our investment strategy targets alternative asset-based investments that generate superior risk-adjusted returns and current income through a combination of acquisitions of cash-flowing assets and asset-based direct lending. We focus on opportunistic, special situations, and bespoke investments that typically have low correlation to economic cycles and public markets. By leveraging our team’s investment expertise in sourcing, innovative structuring, rigorous underwriting, and active management, we mitigate risk and maximize returns.

Asset-Based

Assets/collateral provide downside protection and are the foundation for each investment.

Current Income

Investors benefit from contracted cash flows and distributions.

Active Management

Transaction risks are mitigated through innovative structuring, monitoring and diligent servicing.

Value Proposition

Discrete Investment Strategies

We distinguish ourselves by offering a wide range of fund strategies and discrete investment opportunities, tailored to provide a variety of yields and tenors. This approach ensures that we meet diverse investor needs while focusing on capital growth and risk-adjusted returns.

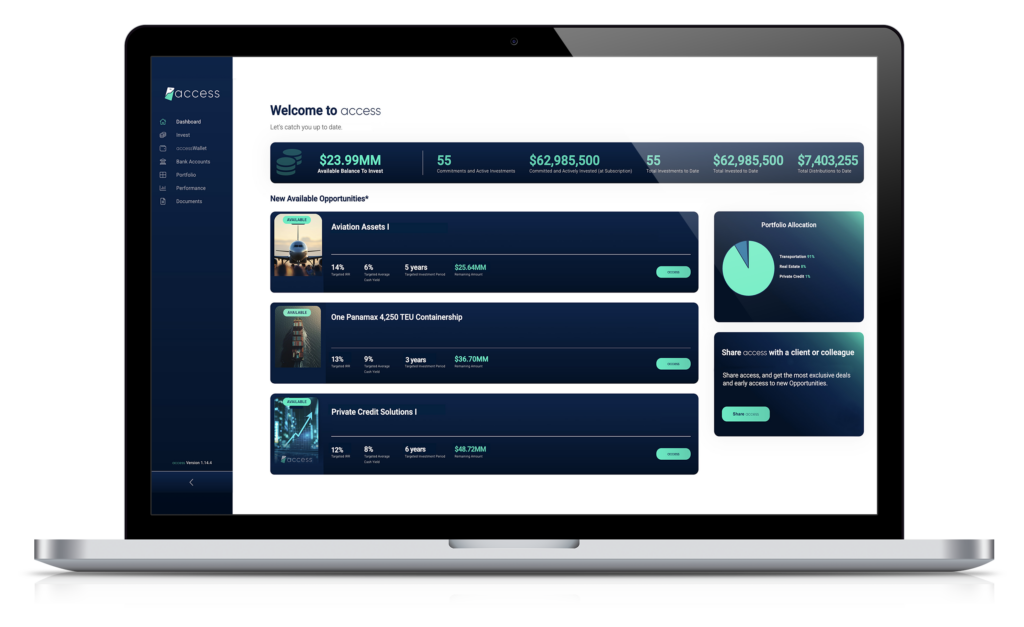

Advanced Technology

Our advanced technology platform improves efficiency and streamlines investor's investment analysis and selection, onboarding and reporting operations, allowing us to deliver superior performance and transparency to our investors.

Disciplined Approach

Our senior investment team, having structured more than $120 billion of alternative investments, has over 200 years of combined experience, with many having worked together through numerous economic cycles, reinforcing our strong culture and enabling a disciplined approach to underwriting and risk management.

Long-Term Perspective

Our multi-asset approach across various industries allows investors to select from differentiated investments that minimize risk and maximize returns. Our broad-based strategy allows us to adapt to dynamic market conditions and capitalize on unique opportunities across the global landscape. We employ a long-term perspective with a focus on capital preservation and downside protection, ensuring stability across market cycles.

We partner with best-in-class industry experts to assist in the sourcing and servicing of assets to maximize investment returns. As an example, in the aviation sector, we are proud to partner with AAR and Skyworks.

Investment Process

Market

Analysis

Sourcing & Structuring

Underwriting

Investment Management

Customized Solutions

We recognize that investor needs and goals are unique, which is why we offer customized investment solutions tailored to specific objectives across the following:

Industries

Assets

Risk Tolerance

Return Profile