Introduction

Access Alternative Investments, Inc. (“access”) is a FinTech company seeking to democratize the world of alternative asset investing, including in the realm of financing commercial aircraft. The Founders of access, as well as its other senior executives, trace much of their experience in alternative investments to the aircraft finance world and, as such, have a deep interest, understanding, expertise, and affection for this asset class.

So, what is Aircraft Finance? ‘Aircraft Finance’ is the art of financing aircraft. It is an “art” because there is no right or wrong way to finance an aircraft. Many factors come into play when assessing the hows to finance an aircraft, many of which relate to corporate policies and perceptions of the future. Before we turn to such an assessment, let us take a look at the breadth of this market.

The Aircraft Finance market is in excess of U.S.$100 billion per year for the financing of new deliveries. Such market for used commercial aircraft is likewise in the many billions of dollars. Driving the size of this market is the fact that commercial aircraft (and related assets) are highly expensive. The smallest in-production Boeing aircraft, for example, the Boeing 737 Max 7, has a list price of almost $100 million, while the largest in production Airbus aircraft, the Airbus A350, has a list price of more than $300 million. Likewise, the engines powering these aircraft are very expensive; the GE-90 engine that powers the Boeing 777 aircraft list at approximately U.S.$24 million each.

Driving airline demand for commercial aircraft are a variety of factors, such as:

- Expansion of route systems

- Replacement of older aircraft to address:

- Increased costs of aircraft maintenance

- Regulatory mandates/aviation directives (noise, pollution, etc.)

- Improved technology

- Greater amenities and benefits to their customers (e.g., increased range)

- Improved operational performance (e.g., fuel efficiency)

- Corporate policy of having a young fleet

Given the price of these assets, the commercial airlines driving the demand for aircraft are required to find ways to finance the acquisition of these assets, since most do not have the luxury of balance sheets that can pay cash to the aircraft manufacturers.

Lease Financing

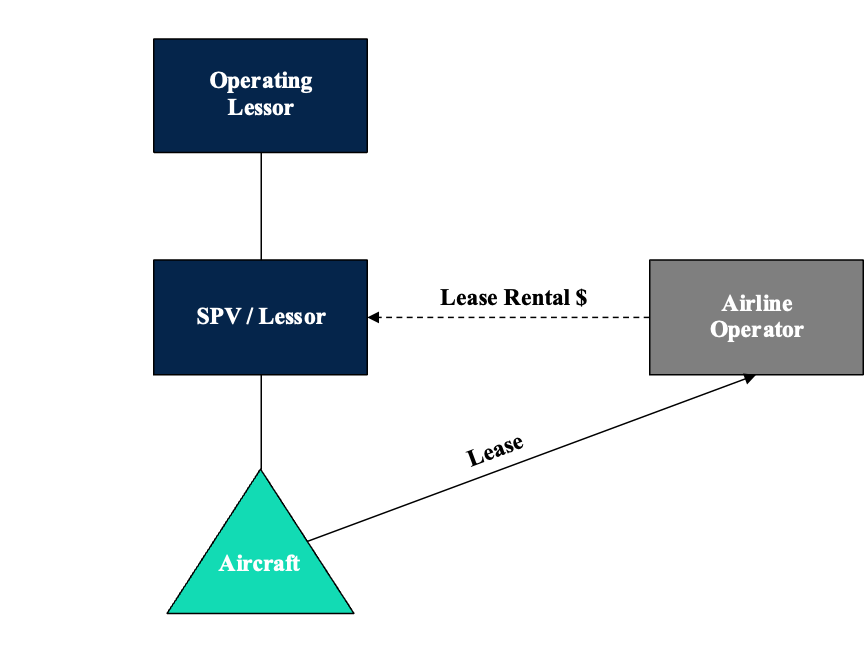

There are two primary methods for financing aircraft: lease financing and debt financing (and, as further described in Appendix A, a combination of these two). In this Primer, which is geared to the novice aircraft investor, I will focus on the first of these two methods, lease financing. Approximately 50% of the world’s commercial aircraft fleet is financed by this financing method, or, more specifically, operating lease financing (meaning that the lease term is shorter than the useful economic life of the aircraft). Lease financing is a method of financing aircraft whereby a third-party leasing company (commonly called the ‘lessor’) acquires the aircraft and leases the aircraft to the airline, the ‘lessee’). The airline, under this structure, gets to use the aircraft for a period of time (the ‘lease term’) and pays rent to the lessor for that privilege. At the end of the lease term, the lessor recovers possession of the leased aircraft.

Diagram 1 below shows the basic structure of a lease financing.

So, what drives aircraft lessors to participate as financiers in this market? Aircraft are generally perceived to be assets that are highly desirable to finance: they feature predictable future values, earn favorable risk-adjusted returns, are actively traded in the secondary market and, in many jurisdictions, are subject to beneficial legal regimes that allow timely recovery in default situations. As between the lessor and the airline, each brings a very different perspective to an Aircraft Finance transaction.

- The airline wants the cheapest possible cost (rent, diminution of the asset value due to utilization and lease end return conditions) and maximum flexibility for utilization of the aircraft.

- The lessor wants the maximum return (rent, maintenance reimbursement and lease return condition) and least amount of risk to its aircraft asset.

Those different perspectives can be summarized, then, by the following relationships.

- Economic Return versus Cost.

- Risk versus Flexibility.

Of course, these two categories are themselves linked: the greater the risk, the greater the required return. Risk tolerance and required levels of return, therefore, necessarily dictate different approaches between the lessor on the one hand, and the airline/operator on the other.

A further, and critical, overlay to this dynamic between the parties is the debtor-creditor relationship amongst them. One of the very essential elements of the risk component is that obligations are largely uni-directional: the airline/operator has the ongoing obligation to pay the rent, insurance coverage, any required airframe or engine maintenance, and return the aircraft, while the aircraft lessor satisfies its obligations on day one by delivering the aircraft.

Lessor Perspective and Analysis

Any aircraft lease transaction is built on five legs:

- the economics of the transaction;

- the credit of the lessee;

- the fair market value of the aircraft;

- the soundness of the transaction structure; and

- the legal framework of the contracts and governing law.

Let’s look at each of these legs in turn.

Transaction Economics – From an investor’s perspective, the economics of an aircraft leasing transaction is perhaps the fundamental element of assessing that transaction. As we will unpack in greater detail below, this element has four key components:

- the aircraft rent;

- the aircraft residual value;

- the maintenance payments associated with the diminution of the utility of the aircraft, engines and associated parts (which will be paid either during the lease (paid on a monthly basis) or by payment at the end of the lease by payment of end of lease compensation); and

- the tax benefits associated with aircraft ownership.

The ability of a lessor to realize on the anticipated transaction economics based on a combination of these four components, such as the targeted internal rate of return (IRR), multiple on invested capital (MOIC), cash on cash return, etc., is necessarily subject to the soundness of the next following four other legs of an aircraft lease transaction.

Airline Credit – The airline/lessee, as the obligor under a lease requiring performance (rental payments, aircraft maintenance and insurance obligations, etc.), needs to have sufficient credit quality to support its obligations under a lease. Most airlines are publicly traded companies whose financial statements are publicly available, so are subject to investor analysis. Even privately-owned airlines, if they want to tap the lessor market, will make available to potential lessors their financial statements. As well, ‘flag carriers,’ and airlines generally, may be perceived to be too-big or too-important to fail, thereby boosting their credit perceptions.1

1 You might recall all of the state support to airlines around the world post-9/11 and during COVID-19.

Accordingly, credit analysts and investors generally can take a view on the creditworthiness of an airline as a lessee under an aircraft lease. Having said that, credit analyses of an airline are based on current (and most recent) financial status and performance. The ability to accurately project the financial credit of an airline for more than a few years into the future is somewhat uncertain. Aircraft leases for new aircraft are often as long as twelve years. In light of such uncertainties, the lessor relies on the support that the aircraft “collateral” provides – the metal.

Aircraft Value – In light of the difficulty for aircraft lessors to ascertain the long-term credit risks of their airline counterparts, the lessors must necessarily rely on an additional element of the transaction structure to support their endeavors. That element is the value of the underlying asset of the transaction, the aircraft. Aircraft have historically held their value over time, depreciating at consistent rates. Unlike a real estate investment, say, where the investor looks for asset appreciation, a key feature of aircraft values is their consistency. Enhancing the ability of lessors to see into the future is the fact that the lead times for ordering and acquiring aircraft is quite long. This gives lessors appreciable visibility into the state of the aircraft market for many years into the future. Thus, lessors can be assured of having generally known value expectations of its aircraft over the life of an aircraft lease, including at the end of a lease term when the lessor will intend to monetize its residual value in the aircraft. As well, if a lessee suffers a credit event that renders it unable to satisfy its obligations under a lease, the related aircraft – having a known utility — can be placed under lease with another airline.

Transaction Structure – The manner by which a lease transaction is structured is an important element for assessing the soundness of a lease financing. While Diagram 1 above shows a commonly deployed leasing structure, this structure may vary depending on the jurisdiction where the lessee is located. Variations come into play to mitigate against, for example, aircraft registration and withholding tax issues. Adding structural complexity to a transaction has the possibility of adding risk to an aircraft leasing transaction, so care must be taken when devising such structures.

Legal Framework – The legal framework for aircraft investing plays a very important role in the soundness of an aircraft leasing transaction. As described above in Aircraft Value, one of the benefits of investing in aircraft is the ability to take an aircraft back from a defaulting airline lessee and redeploying it with another airline so that the investor/lessor can continue to have an earning asset in the form of rent from its asset. Asset financings of most non-aircraft classes of assets run the risk that the bankruptcy of a lessee may delay for months (or years) the ability to repossess these assets. Aircraft, fortunately, have the benefit of special bankruptcy and international treaty rights. These rights, known colloquially as “Section 1110” [referring to the Section in the U.S. Bankruptcy Code] and “Cape Town” [referring to the international treaty convention], provide aircraft lessors with relative certainty that should an airline file for bankruptcy, that airline must, within 60 days (or some other number of days between 60 and 180 days under the Cape Town treaty) of its bankruptcy filing, either (A) return the aircraft to the lessor or (B) agree to (i) continue paying contractual rent and (ii) cure past due rent and other defaults. These laws are powerful risk mitigants, and have been a tremendous boon to aircraft financings. In fact, given these legal protections, U.S. rating agencies have historically provided investment grade ratings to a product called enhanced equipment trust certificates (EETCs). To be sure, Section 1110 and Cape Town-like protections are not available in all jurisdictions, so an examination of local laws and enforcement mechanisms needs to be made for any particular transaction.

Transaction Economics

There are four economic factors an investor in a commercial aircraft, a lessor, will consider when determining the return on its investment in a commercial aircraft when it buys it for or on lease to an airline:

- The rental income payable by the airline, as lessee, for leasing the aircraft

- Any financial adjustments payable by the airline at the end of the lease term when the airline must return the aircraft

- The residual value of the aircraft, that is, the value of the aircraft at the time the aircraft is returned by the airline

- The tax benefits, if any, it may receive from its ownership of the aircraft

Each of these items will have its own level of predictability. Let’s look at each of these in turn.

First, let us look at Rental Income –The payment of rent provides the investor with a steady and predictable source of cash flow over the life of the related lease since the amount of the rent is a contractual obligation. The primary risk factor with respect to this feature of the return is the credit of the lessee.

Second, let us consider Maintenance Reserves or End-of-Lease Financial Adjustments – Maintenance Reserves, paid to the lessor during the lease term to provide reimbursement to the lessor that the required funds are available to perform required maintenance on the aircraft during the lease (this mechanism is typically featured in leases with airline operators that have a financial credit profile that is less than investment grade quality) — or end of lease financial adjustments (EOLA), which are the adjustments an aircraft lessee must pay at the end of a lease to compensate the owner of the aircraft for the lessee’s “using up” the maintenance condition of the aircraft and its component parts relative to the condition of the aircraft when the aircraft was originally delivered to the lessee. The amount of an EOLA for a given aircraft is fairly predictable insofar as a lessee’s level of usage of an aircraft is a relatively safe assumption. As with Rental Income, the primary risk factor with respect to this feature of the return element is the credit of the airline lessee.

The third item for assessing the return a lessor receives from an aircraft is its Residual Value – The residual value of an aircraft is the value of that aircraft at a particular time in the future, usually at the end of a lease term. When an aircraft’s lease terminates, the owner of the aircraft has three primary options for its aircraft asset: (1) sell the aircraft; (2) lease the aircraft; or (3) lease the aircraft and sell it subject to the lease. If the lessor wants to monetize the value of the aircraft at the end of the lease, it will seek to sell the aircraft, and, typically, the value of the aircraft will be enhanced for such a sale if there is a lease attached to the aircraft. In certain circumstances, however, if the aircraft is old (and has reached or is near the end of its economic useful life as a whole operating aircraft) and the cost of refurbishment is costly, the best option to monetize the aircraft’s residual value would likely be to disassemble the aircraft (commonly referred to as “parting it out”) and sell the engines and parts into what is a fairly robust engine and used parts market. The risk factors for assessing residual value on a prospective basis primarily pertain to forecasting the demand for the particular manufacturer and model of the aircraft (narrow body vs. wide body, Boeing vs. Airbus, type of engine, configuration, age of the aircraft, etc.). The predictability of an aircraft’s residual value is somewhat dependent on the time horizon for monetizing the aircraft, with shorter time horizons offering the best level of predictability in light of the ability to benchmark more recent market sales. Importantly, there is no certainty as to the residual value of an aircraft in the future, but educated estimates can be made and third-party appraisers may offer some guidance.

Finally, the fourth element in assessing the value of an aircraft investment is any tax benefits that may be available to an aircraft investor – Tax benefits from owning an aircraft may include items like depreciation (which in some instances may be accelerated) and interest cost deductions. Tax benefits will be dependent on where the operator of the aircraft is based and attributes of the investor himself. When considering the tax benefits available to an investor in commercial aircraft, we will be requiring investors to consult with their own tax advisors to assess the tax benefits that might be available. If an investor does qualify for tax benefits, this element of an aircraft’s profitability is both enhanced and predictable.

The access Advantage

access, and its team of management professionals, have over 170 combined years of experience in the aircraft finance industry, having collectively completed over $120 Billion of transactions in this space during this time span. Borrowing from the above analysis, the access team is in a unique position to address the aircraft investing landscape based on the following:

- the economics of the transaction;

- the aircraft rent – The access team uses sophisticated modelling techniques to analyze and support its assumptions on IRR, MOIC and other investment parameters

- the aircraft residual value – The access team primarily focuses on shorter term leases giving the team improved visibility on future aircraft values and also focuses on mid-to-end of life aircraft which avoids risks associated with the newest technology

- the maintenance reserves and end of lease compensation – As with aircraft rent, the access team uses its models to forecast with a high degree of accuracy the funds which will remain in a maintenance reserve account or from the end of lease compensation expected to be due from lessees

- the tax benefits associated with aircraft ownership

- the credit of the lessee – The access team undertakes rigorous credit analyses of lessees

- the value of the aircraft – The access team works with best-in-class servicers to ensure that lessees are in compliance with the terms of the lease so as to best preserve the condition of the aircraft

- the soundness of the transaction structure – The access team works with best-in-class accountants and lawyers to ensure that transaction structures are sound.

- the legal framework of the contracts and governing law – The access team works with top tier law firms to ensure that legal risks, including repossession risks, are mitigated.

Importantly, the access advantage comes not just from the intellectual firepower that the team brings to the fore, but also from the vast industry contacts and experience the team has. This intangible benefit allows the access team to source and create transactions that few in the industry can muster.

Appendix A

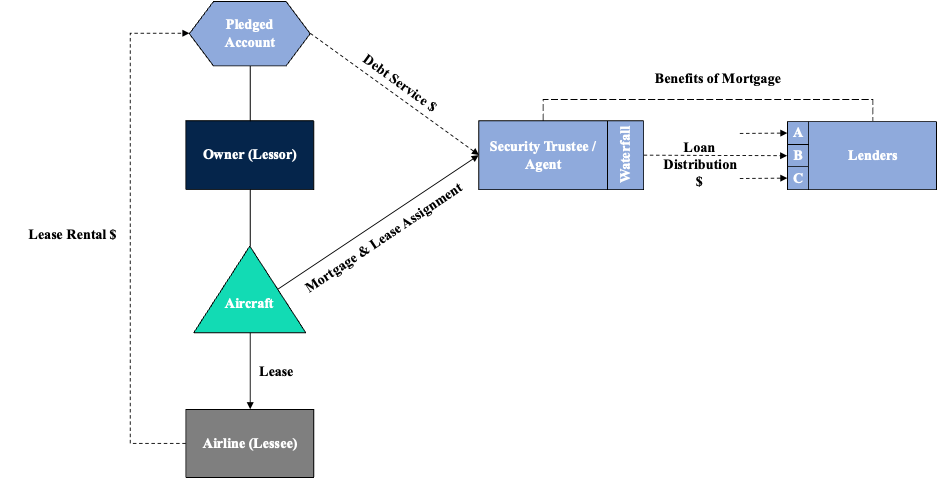

Given the high cost of aircraft, investors/lessors, just like the airlines, often need to find financing to acquire such expensive assets. A primary mechanism for lessors to obtain this financing is to borrow it from lenders. In this type of financing, known as a back-leveraged financing, the lessor will borrow some portion of the purchase price of an aircraft and the lender will receive, as security for its loan, a mortgage on the aircraft and an assignment of the related lease. The debt service requirements under such loan are serviced by the rentals paid by the airline under the lease of the aircraft. The below schematic diagram illustrates how this is done. Insofar as such rentals may not be sufficient to repay such loan in full, the related aircraft may need to be sold to pay off any resulting balloon.

For the lessor, this is a very favorable form of financing but not without its risks. For example, if a lessee defaults in the payment of rent, the lender may take management of the lease and the aircraft away from the lessor, and may foreclose on the aircraft depriving the lessor of its equity.